Blog

Insights & Research

Portfolio management, financial engineering, and our journey building RAIIS.

Green Fees Series

A multi-part research series examining how ESG constraints affect portfolio performance and transaction costs.

Before the Green Fees: Why ESG Portfolio Management Isn't Straightforward

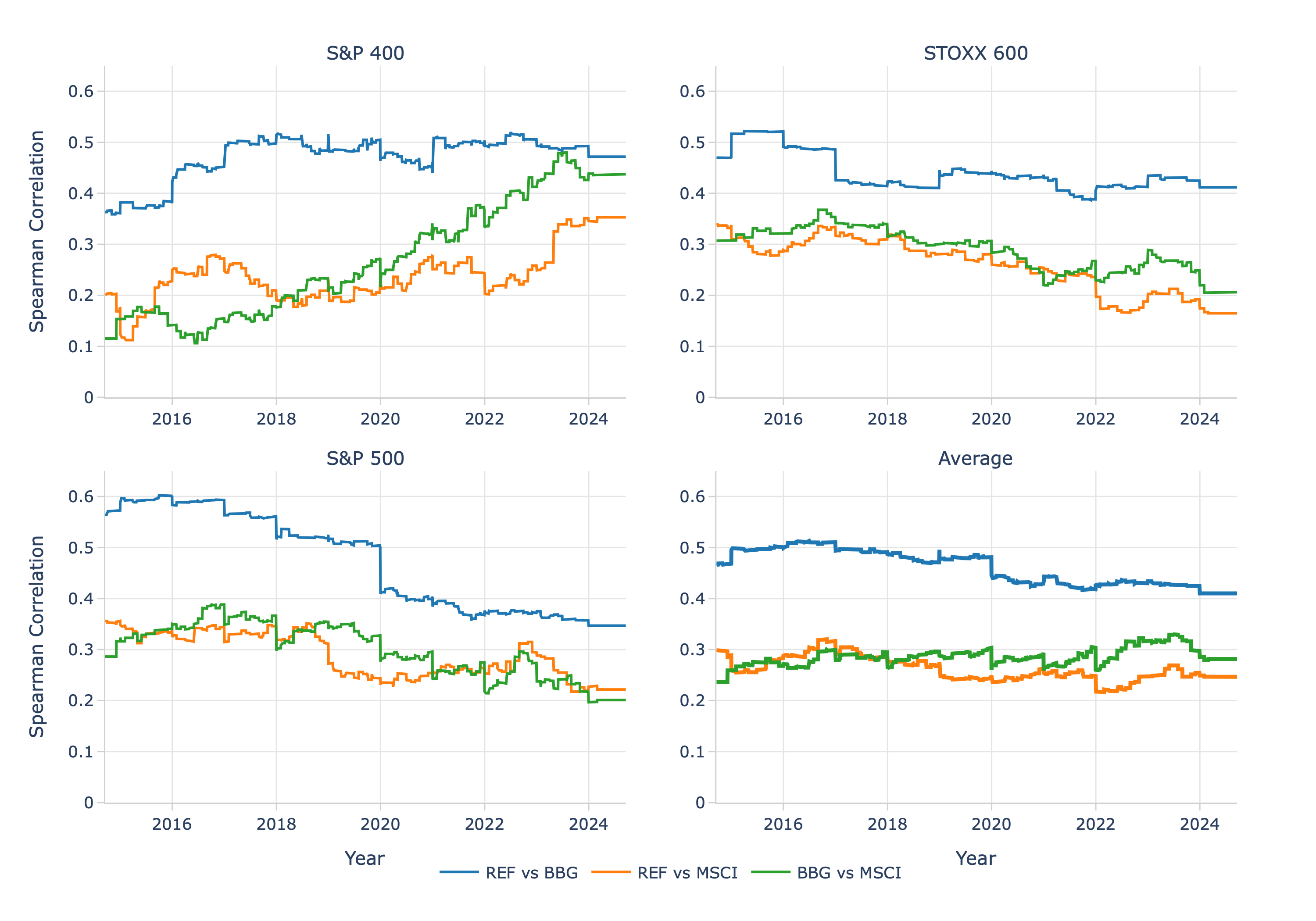

Unpacking the problem of inconsistent ratings, rising regulation, and performance uncertainty in ESG investing.

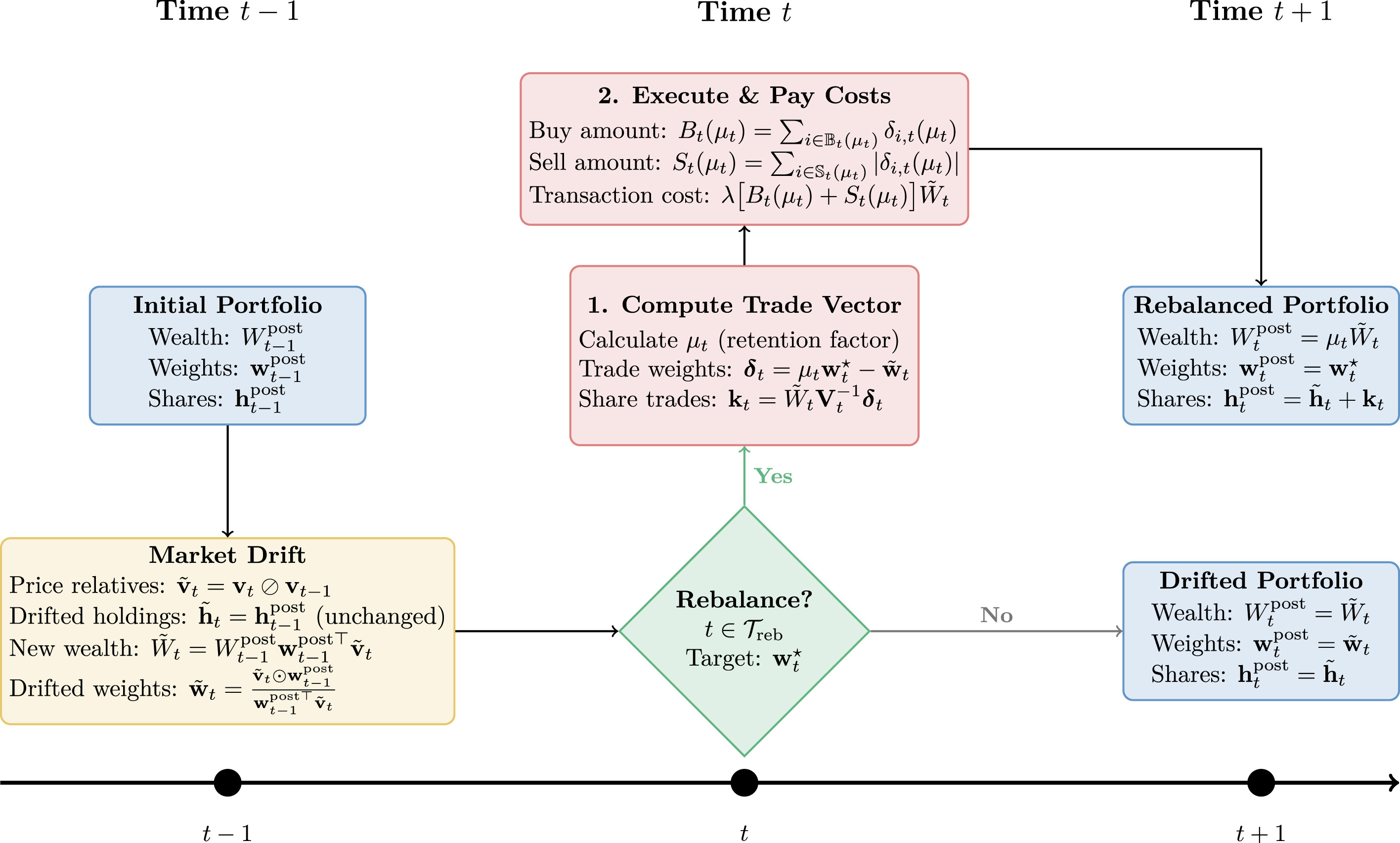

Green Fees: The Methodology Behind Measuring ESG Portfolio Impacts

A rigorous framework for assessing how sustainability screening affects performance and costs.

Technical

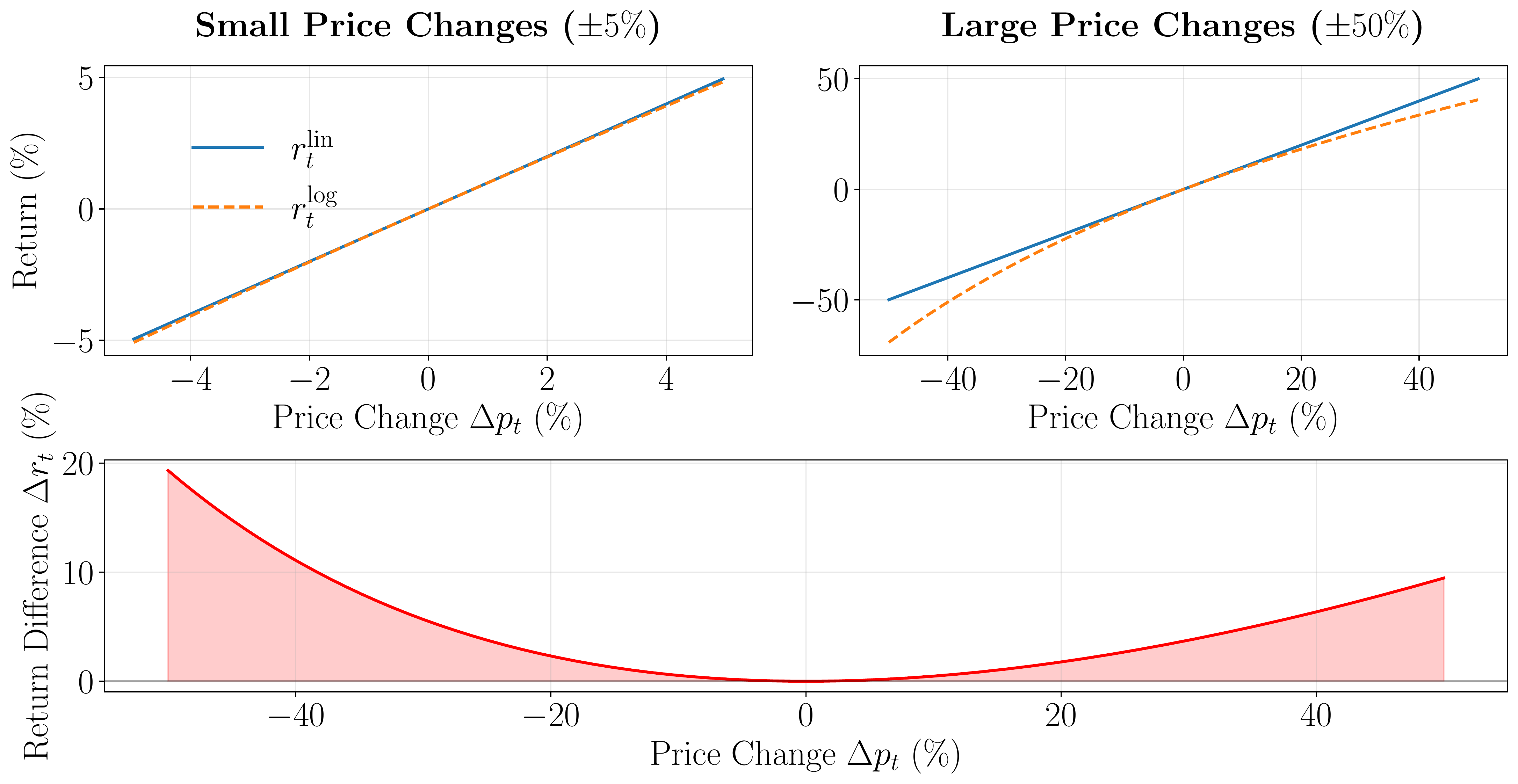

Portfolio Evaluation and Return Analysis

The mathematical framework for return analysis, comparing linear and logarithmic returns, and their practical implications for risk management.

General

RAIIS Early-Stage

Entrepreneurship rarely follows a straight line. It moves between the spark of an idea, the grind of execution, and the challenge of aligning value with real market needs.